GM, is it though? is it a GM?

Today, we're diving into the murky waters of stablecoins and traditional banking with a double whammy of news.

Here’s what we are covering Today :

How SVB Caused USDC to Crash. 😰

(not what everyone is telling you)

Why did USDC Deped? 😱

This is Something that will shake your avatar in your digital boots, as it is doing ours. Before we dive right in, we need to backtrack to SVB.

📉Why did Silicon Valley Bank Collapse ?

The bank that was once the go-to for startup founders is now being sold for scraps after just 30 hours of chaos.

So, what happened?

SVB had positioned itself as the bank for founders, and during the pandemic, they saw a surge in deposits from startups that had just signed fat Series A rounds.

Deposits grew from $60 billion in 2019 to over $189 billion in 2022 - a massive increase in just a few short years.

With all that money rolling in, SVB wanted to put it to work.

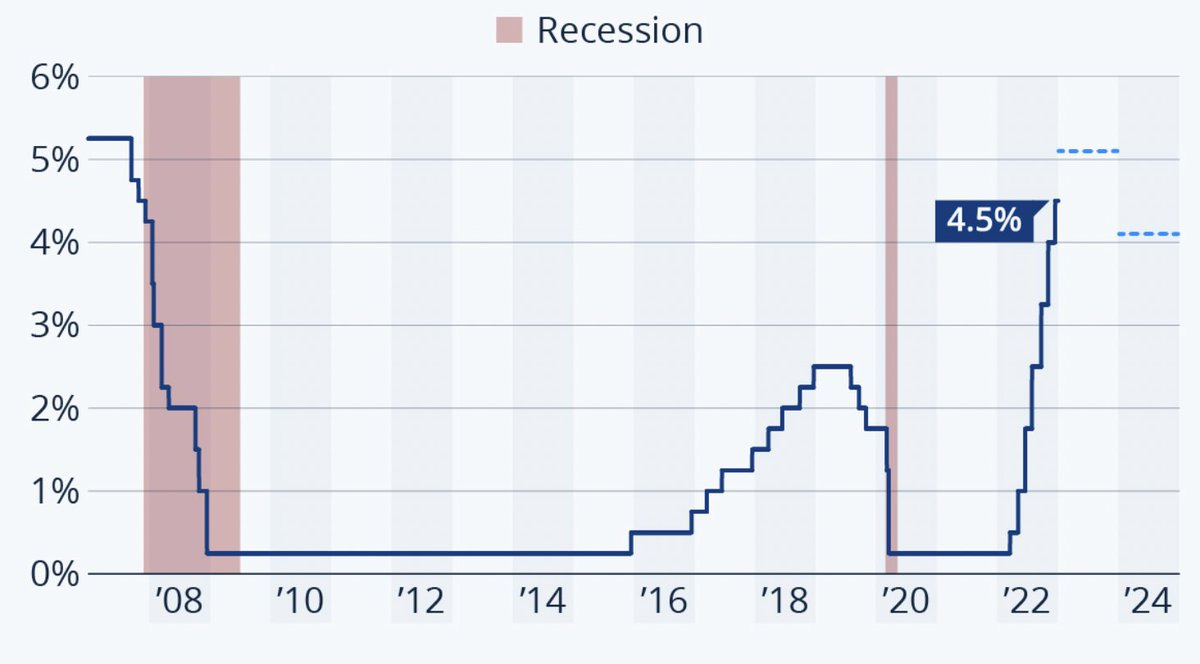

They ended up buying $80 billion in Mortgage Backed Securities (MBS) with an average yield of 1.5%.

At the time, with interest rates at historic lows, that 1.5% yield didn't look half bad.

But then interest rates started to rise. With every rate hike, the $80 billion SVB had locked up looked worse and worse.

And on top of that, deposits started to fall as absurd valuations and checks startups were getting came back down to earth.

In a more precarious position than before, SVB decided to sell some securities at a loss in order to give themselves a little breathing room.

The idea was to free up more capital and improve their liquidity.

But as it turned out, that was a HUGE mistake. Even though SVB didn't have a liquidity problem, investors got spooked and reacted as if it did.

A hilariously bad and convoluted press release yesterday only served to make investors more nervous.

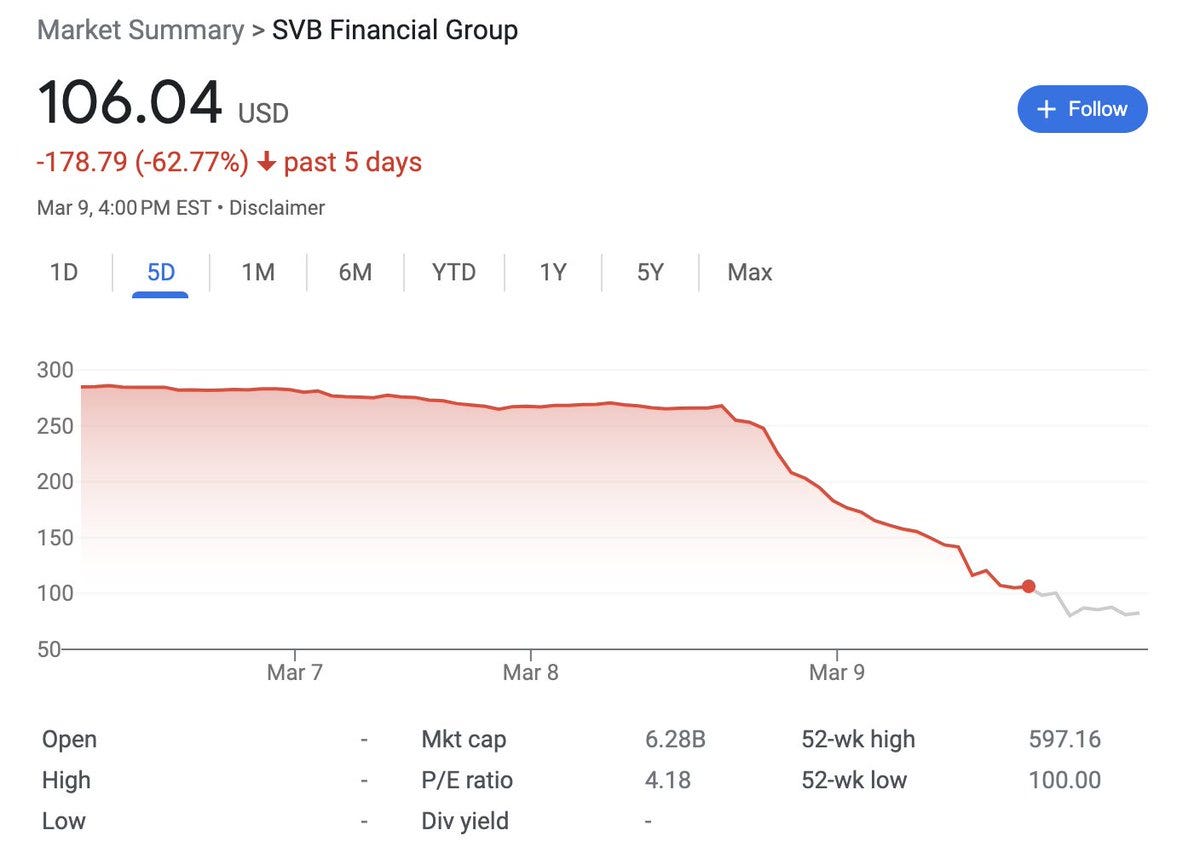

Over the past two trading days, SVB is down over 70% and still falling.

As the stock continues to free fall, SVB has wisely decided to scrap its capital raise not because they realized it was a bad idea, but because they are now considering a sale.

All of this has obviously spooked founders as well. Lots of VCs have jumped in to advise founders to get their money out of SVB, sparking a bank run.

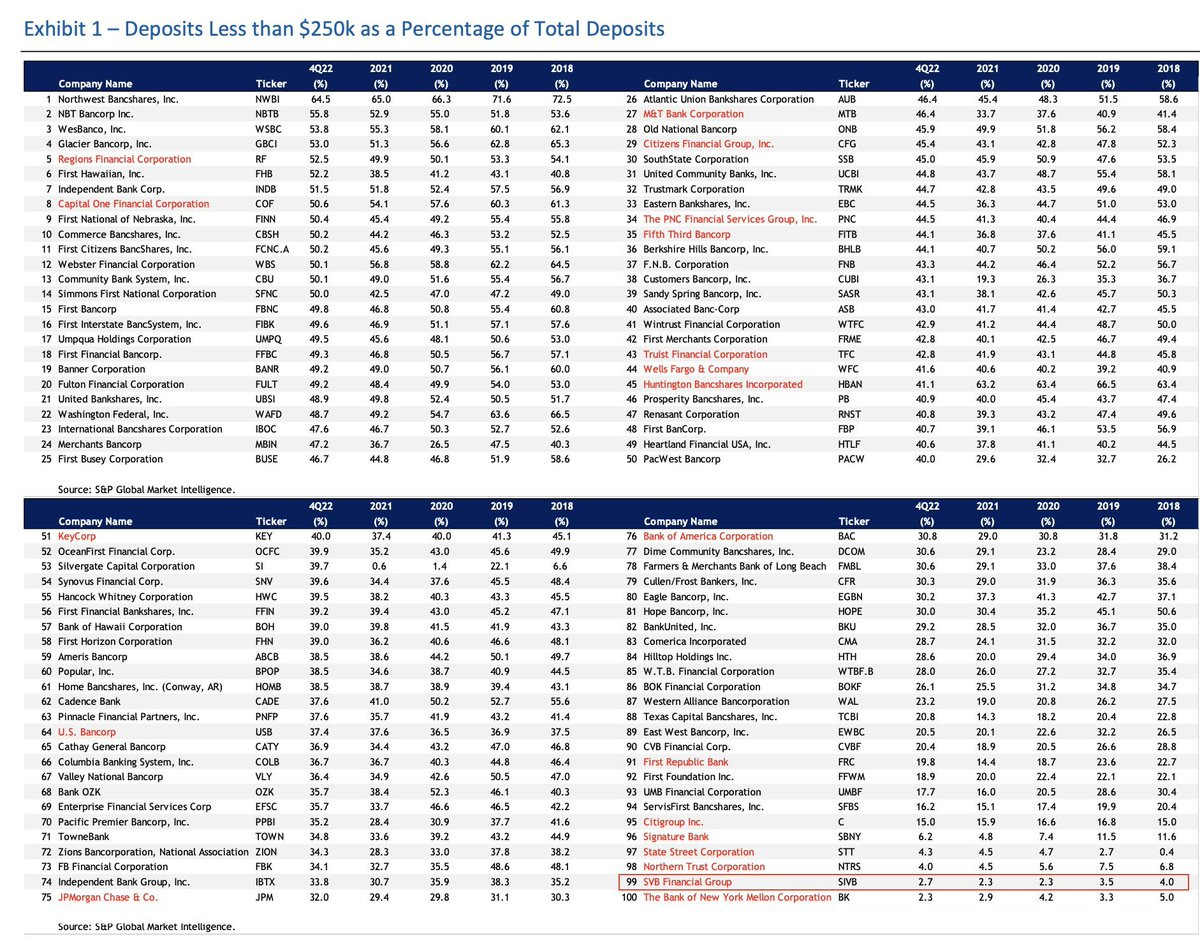

Making matters worse, only 2.7% of SVB deposits are FDIC insured, meaning that 97.3% aren't.

It's truly wild to see how SVB went from one of the most important banks in the startup world with 8,500 employees, to being sold for scraps in the span of 30 hours.

But that ain’t it.

SVB's collapse has caused a chain reaction that has led to the depegging of USDC and a 10% drop in the stablecoin's value.

How did SVB's collapse cause USDC to crash?

Now, here's where things get interesting.

SVB is a major shareholder in Circle, the company that issues USDC.

When investors started to pull their money out of SVB, they also started to sell their shares in Circle. This caused the value of Circle's assets to drop, which, in turn, caused the value of USDC to drop.

USDC, for those who don't know, is a stablecoin that is pegged to the value of the US dollar. It's a popular choice for traders and investors who want to avoid the volatility of other cryptocurrencies.

But why did USDC depeg?

Well, as we mentioned earlier, USDC is pegged to the value of the US dollar. When the value of USDC dropped, it meant that one USDC was no longer worth one US dollar. This caused the coin to depeg.

So what does this mean for the world of cryptocurrency?

Well, for starters, it shows just how interconnected the world of finance and cryptocurrency really is. Even stablecoins like USDC, which are supposed to be insulated from the volatility of other cryptocurrencies, can be affected by events in the traditional financial world.

But, for More, some see it as an arbitrage opportunity to make easy 5-10% by swapping USDT into USDC right now. Some are scared of their scares of Luna, & worried about their exposure to USDC ( including me ).

What do we do?

Either put capital in to USDC through USDT if you wan’t arbitrage & got some dry powder or Sell at 10% loss for capital preservation, or just wait if you already got exposure & believe in circle or USDC (like Me).

It also shows that the stability of stablecoins is not guaranteed.

While stablecoins are designed to be pegged to the value of a stable asset, such as the US dollar, they can still be impacted by external factors, such as bank collapses or currency collapses.

While the full extent of these consequences is yet to be seen, it's clear that events in the traditional financial world can have a significant impact on the world of crypto.

As always, we'll be keeping a close eye on this story and will keep you updated on any new developments.

That’s it for today folks, thanks for tuning in.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. Please be careful and do your own research