What If BTC ETF Ins't Approved or Delayed?

Plus: Will ₿TC Breakout If ETF Is Approved?

The Bitcoin ETF Storm: Market Reflections and Future Strategies

An In-Depth Analysis by CoinBasics

Bitcoin ETF applicants unveil their S-1 filings, marking the penultimate step before a potential SEC approval.

The very fact that applicants are advancing to this stage suggests optimism in the air; after all, why file S-1s if the SEC were poised to reject the applications?

As the ETF saga unfolds, a fascinating "race to the bottom" in fees among applicants is taking center stage.

The logic is clear: a more attractive ETF, characterized by lower fees, stands to garner larger liquidity flow.

It's a strategic maneuver aimed at emerging as the early winner in the impending ETF competition.

The ETF Conundrum: What If They Aren't Approved?

The looming question of ETF approval hangs in the balance.

While the SEC's communication suggests a favorable outcome, the concern arises from significant sell-offs in Coinbase shares, accompanied by notable insider selling over the past month.

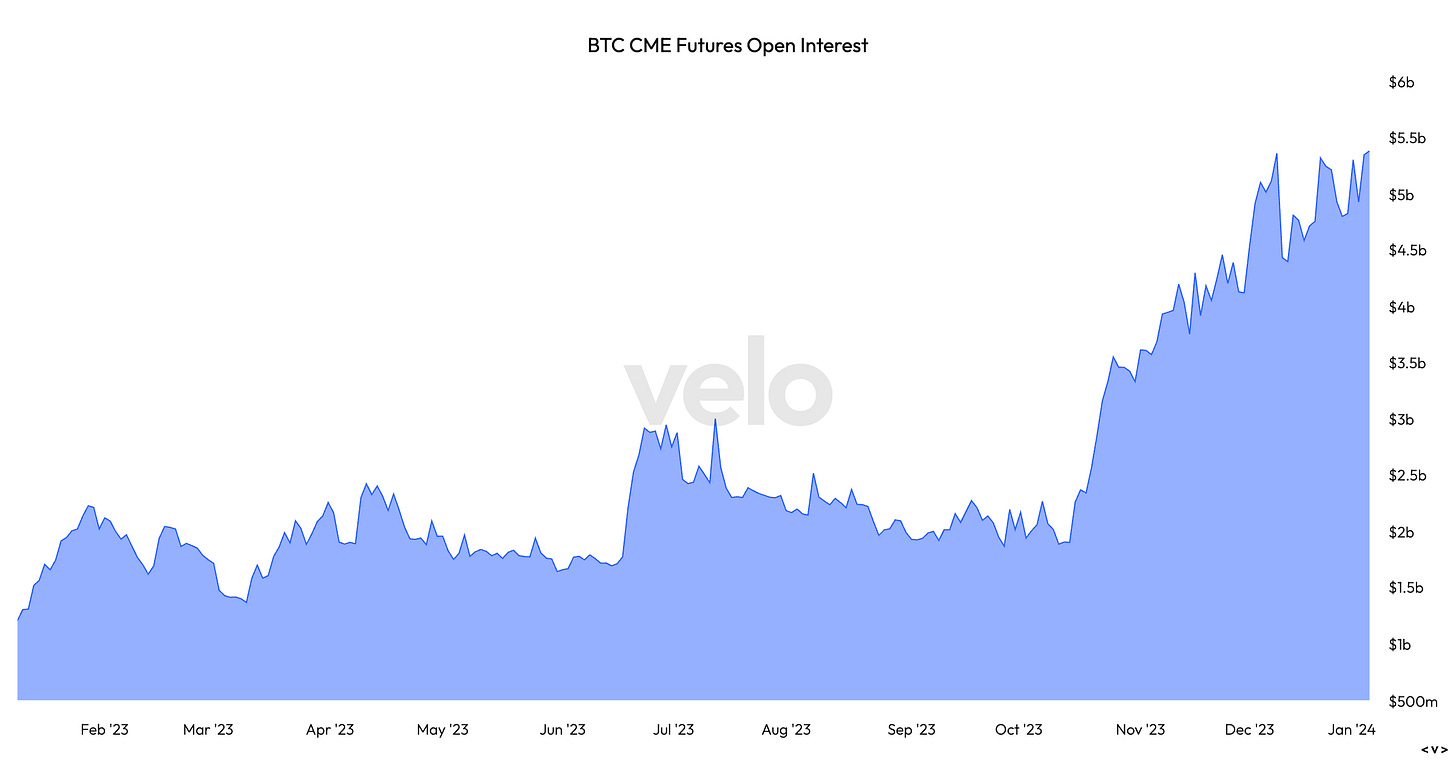

Yet, the sustained high Open Interest on CME for Bitcoin hints that TradFi participants haven't hastily closed positions.

Potential Scenarios: Rejection, Postponement, or Approval Surge?

Contemplating hypotheticals, CoinBasics envisions potential outcomes if ETFs face rejection or postponement.

A rejection could trigger a temporary market downturn, an 'armageddon' scenario lasting about a week. In this scenario, strategic buying a week later could present lucrative opportunities.

If the decision is postponed, the market's response hinges on the reasons for the delay. Regardless, a postponement encourages aggressive dip buys, presenting opportunities for shrewd investors.

Here’s a strategic approach :

In the face of forthcoming market challenges, the focus shifts to scaling into attractive opportunities.

Identifying coins that have witnessed substantial corrections but maintained strong recent performances becomes a key strategy.

The macro markets are predicted to tread cautiously, possibly trading lower in the coming months as interest rates undergo a reassessment.

Mechanical Improvements and Market Dynamics

From a mechanical standpoint, Bitcoin is presenting a cleaner and more robust picture compared to a week ago. This positive momentum extends to altcoins, painting a broadly optimistic outlook.

Several indicators are flashing encouraging signals. Open Interest is on a downward trajectory, mirroring a decline in Funding Rates.

The recent market selloff has induced caution, prompting a retreat of many traders. Now, the stage seems set for prices to surge, aided by the potential ETF pump.

Technical Analysis: Bitcoin's Breakout Amid ETF Approval Anticipation

As the cryptocurrency community braces for the potential approval of Bitcoin ETFs, technical analysis paints a compelling picture of Bitcoin's immediate future.

Breakout Indicators:

Horizontal Resistance at $44,000: Bitcoin is making a determined attempt to breach the horizontal resistance at $44,000. If successful, the next focal point becomes the prior high of $45,900.

Key Support Levels: For this bullish scenario to hold, $44,000 must transition into a new local support. Losing this level could see the price declining to at least $42,400, with $40,900 remaining a crucial horizontal support.

RSI Analysis:

Optimistic Reset: The Relative Strength Index (RSI) shows a positive reset on the 12-hour and 1D timeframes, indicating a favorable position. However, caution is warranted as the 3D RSI is inching back into overbought territory, while the Weekly RSI remains overbought. A more substantial reset is anticipated in the coming months.

CoinBasics' Take: Navigating Uncertainty with Strategic Resilience

Despite concerns, CoinBasics maintains optimism regarding ETF approval. The observed sell-off in Coinbase shares does raise alarms, but the strategy remains to hold positions and allocate a significant portion to USDT for potential major dips.

Spot Positions: A Silver Lining in the Storm

Despite the upheaval, the advice to hold onto Spot positions proved valuable. Altcoin prices, having doubled or tripled over the last three months, weathered the storm. The call for caution, coupled with maintaining Spot positions, cushioned the impact of the 15% flush-out. The reminder to 'zoom out' becomes crucial; a short-term setback should not overshadow the gains accrued over the preceding months.

Acknowledging the prudence exercised in the past few months, CoinBasics advocates for maintaining positions and awaiting the ETF decision's aftermath before reassessing. A long-term bullish sentiment prevails, with macro challenges likely paving the way for favorable dip-buying opportunities.

₿itcoin ETF Odyssey: An Aftermath of Possibilities

An insightful exploration by CoinBasics - Navigating the Crypto Landscape with Wisdom and Strategy.

Disclaimer: Not financial or investment advice, just insights, no signals or financial advice.